"This Time It's Different" - Why it rarely is

- will0420

- Apr 28, 2025

- 3 min read

“The four most expensive words in the English language are: ‘This time it’s different.’”

— Sir John Templeton

Market turmoil is nothing new. The headlines change. The catalysts change. But the pattern? It’s almost always the same.

Today’s news cycle might focus on political events, economic indicators, or unexpected shocks — tariffs, elections, wars, financial scandals. Right now, it might be Trump’s tariffs that have sparked volatility and a sharp market sell-off. But if you zoom out, the market’s reaction is following a script we’ve seen time and again:

A sudden decline in asset prices.

Heightened volatility and extreme swings day-to-day.

Wild overreactions to both good and bad news.

Calls for government bailouts, intervention, or stimulus.

And, inevitably, that familiar chorus insisting: "This time it's different."

But history teaches us otherwise.

Despite wars, recessions, pandemics, financial crises, political upheavals, and technological disruptions, markets — particularly diversified ones like the U.S. — have shown extraordinary resilience over time. A long-term chart of U.S. equities, like the one from Morningstar (https://www.morningstar.com/economy/what-weve-learned-150-years-stock-market-crashes), illustrates this clearly: while there are bumps, crashes, and corrections along the way, the long-term trend is up.

In short: it's rarely different this time.

How Investors Should Respond

In periods of uncertainty, fear often drives bad decisions. The most important actions you can take as an investor remain constant — and they’re often the least exciting:

Stick to a long-term strategy. Constant tinkering usually destroys value rather than creating it.

Invest at a risk level that matches your goals and comfort. It’s vital your portfolio is designed to handle volatility without causing you sleepless nights.

Minimise unnecessary fees. Costs are one of the few things you can control. Lower fees mean more of the market return stays in your pocket.

Maintain sufficient liquidity and emergency funds. This allows you to avoid becoming a forced seller in a downturn — giving your investments the time they need to recover.

The legendary Warren Buffett put it simply:

"Be fearful when others are greedy and greedy when others are fearful."

That’s easier said than done when headlines scream panic. But it’s also when discipline is rewarded.

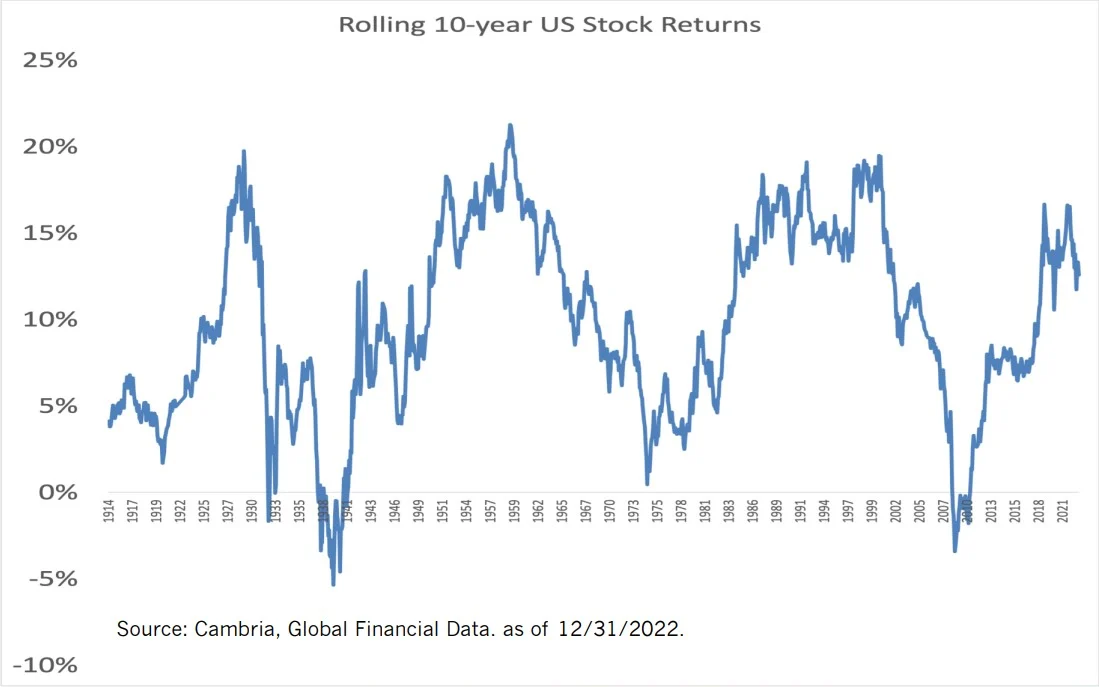

A Long-Term Perspective: 10-Year Rolling Returns

One way to understand market resilience is to look at 10-year rolling returns on U.S. equities (https://www.crews.bank/blog/rolling-10-year-returns).

Data covering the period from 1914 to the end of 2022 shows that, over any 10-year period, investors usually experienced positive returns — despite the chaos of the Great Depression, World Wars, inflationary crises, and the Great Financial Crisis. In fact, there were only two major periods where 10-year returns turned negative:

During the Great Depression of the 1930s.

Following the Great Financial Crisis of 2008.

Even during these rare instances, the subsequent recoveries were substantial for those who remained invested.Could we see another difficult period ahead? Maybe. Maybe not. But that’s not the point.

The key takeaway is this: you must build your financial plan to account for bear markets. You need flexibility, liquidity, and a margin of safety built into your strategy so you can stay the course when markets get rough.

Final Thoughts

Every market downturn feels unique in the moment. The triggers might differ, the headlines might feel more dramatic, and the uncertainty can seem overwhelming. But history reminds us: it’s almost never "different this time."

Long-term investing success is about patience, discipline, and managing the parts you can control.

At Wealth Differently, we help our clients design portfolios and financial plans that are robust enough to weather uncertainty — and simple enough to stick to.

If you’d like to review your strategy to ensure it’s prepared for whatever comes next, get in touch. https://www.wealthdifferently.com/

or click here to book an intro call

Comments